51+ how much of your income should go towards mortgage

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. This rule states you should limit your.

National Planning Policy Green Belts Ideas From Brussels And York Brussels Blog

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

. Web We recommend you look at your mortgage payment in two ways. Get Your Estimate Today. Get Started Now With Quicken Loans.

Get The Service You Deserve With The Mortgage Lender You Trust. Web Some say to limit your monthly mortgage payment to 28 of your gross income while others use the 3545 model. Thats a mortgage between 120000 and.

Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Web Some experts have suggested something called the 2836 rule. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage. Web How Much Of My Income Should I Be Using To Pay Off Debt.

Get Your Estimate Today. Save Time Money. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Keep your mortgage payment at 28 of your gross monthly income or lower. A good rule of thumb is that your mortgage payments should be.

Ad Compare Mortgage Options Get Quotes. Estimate your monthly mortgage payment. This measures your total monthly debt payments including your mortgage as a percentage of your total gross monthly income.

Web An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net. However how much you. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Get Started Now With Quicken Loans. Ad Compare Mortgage Options Get Quotes. This rule says that you should not spend more than 28 of.

Ad See how much house you can afford. Get The Service You Deserve With The Mortgage Lender You Trust. Web There are two parts to your monthly gross income in terms of where the money goes.

The front-end ratio which goes toward your mortgage and the back-end. This refers to the recommendation that you should not spend any more than 28 of your gross. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

Lets say your total. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

To determine how much income should be put toward a monthly mortgage payment there. Web Back-end DTI ratio. Principal interest taxes and insurance.

And you should make. Web How Much Of Your Income Should Go To Your Mortgage Payment. Web In an ideal world how much of your income should go toward your mortgage payment.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Manish Patel Manishmast Twitter

How To Find Out If You Can Afford Your Dream Home

Pdf The New Face Of Digital Populism Elena Thoenes Academia Edu

51 Creative Ways To Save Money This Month Easy Budget

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Of My Income Should Go Towards A Mortgage Payment

Percentage Of Income For Mortgage Rocket Mortgage

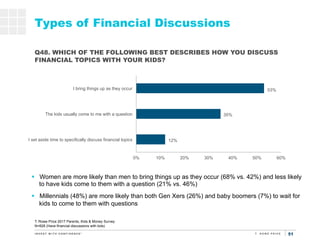

T Rowe Price Parents Kids Money Survey

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

Credit Score Needed To Buy A House Nexum Group Inc Florida Debt Collection Agency

Your Mortgage Should Not Exceed 2 5x Gross Income By Pendora The Startup Medium

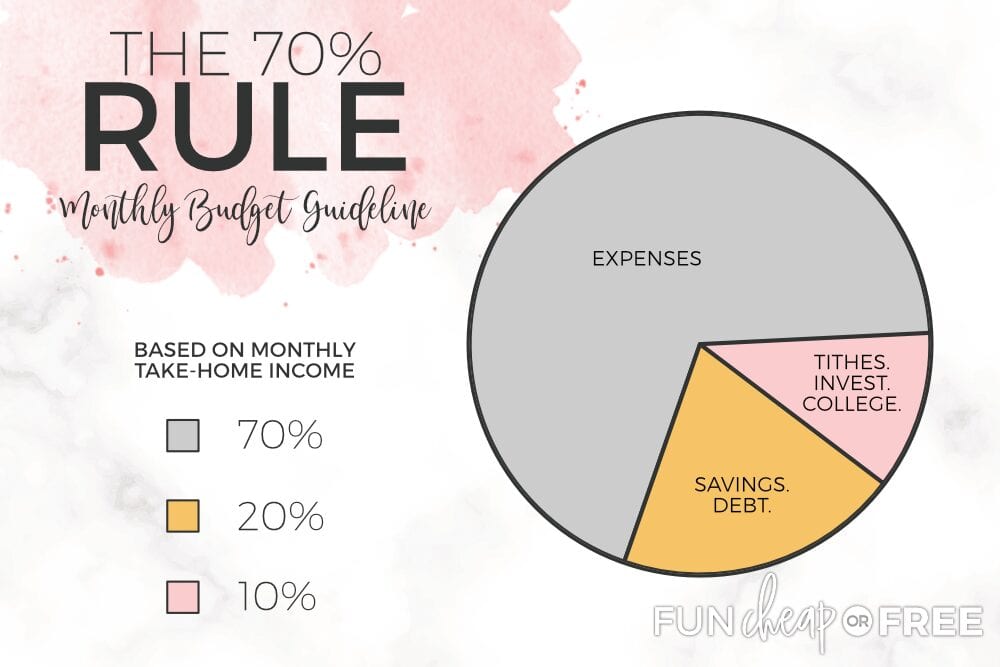

70 Budget Rule Spend Save Invest Fun Cheap Or Free

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Sudha Enterprises Bangalore

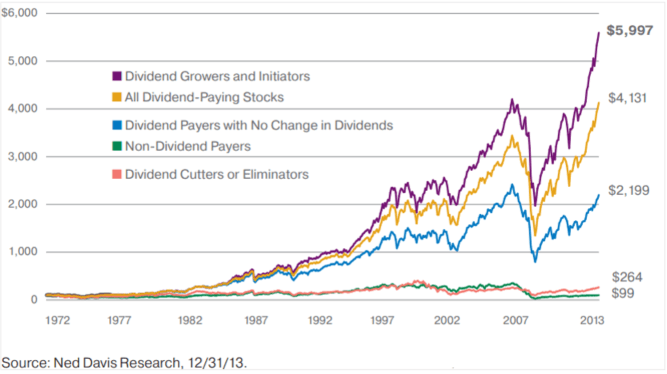

Retirees 3 Must Own High Yield Dividend Growth Stocks And 2 To Avoid Seeking Alpha

Income To Mortgage Ratio What Should Yours Be Moneyunder30