10+ venmo loan money

Account holders can transfer funds to others via a mobile phone app. Can make and receive payments through desktop and.

A Case Study On Venmo A College Student S Perspective On By Joy Harjanto Prototypr

Heres an explanation of how our credit builder loan helps you get some money for today while building credit and savings for tomorrow.

. A good mix shows creditors you can handle different types of debts. We would like to show you a description here but the site wont allow us. If you work at a bank or credit union that offers personal loans use this free Personal Loan Application Form to easily accept loan applications online no more messy paperwork or manually scanning forms into your system.

Consequences of Defaulting on Federal Student Loans. What It Is How It Works Pros Cons. If your bank doesnt offer Zelle your limit for sending money is 500 per week.

Google Pay is similar to the services above and you can link it to or use it to pay for Google products and services. What Is Zelles Transfer Limit. Despite recent setbacks cryptocurrency has remained a wildly popular new asset class for investors.

Is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers and serves as an electronic alternative to traditional paper methods such as checks and money ordersThe company operates as a payment processor for online vendors auction sites and. Its also more suitable for small businesses. In addition purchases made using third.

A personal loan can be used to pay off credit card debt throw a dream wedding or take on a big home improvement project. Combine the flexibility of a credit card with the predictability of a personal loan. In 2018 Cash App added the ability to buy and sell Bitcoin as well which gives it a unique feature compared to other popular payment apps.

Defaulting on a federal student loan can come with even heftier consequences. From 1911 to 1967 the Postal Service also operated the United States Postal Savings System not unlike a savings and loan association with the amount of the deposit limited. The 25 Most Influential New Voices of Money.

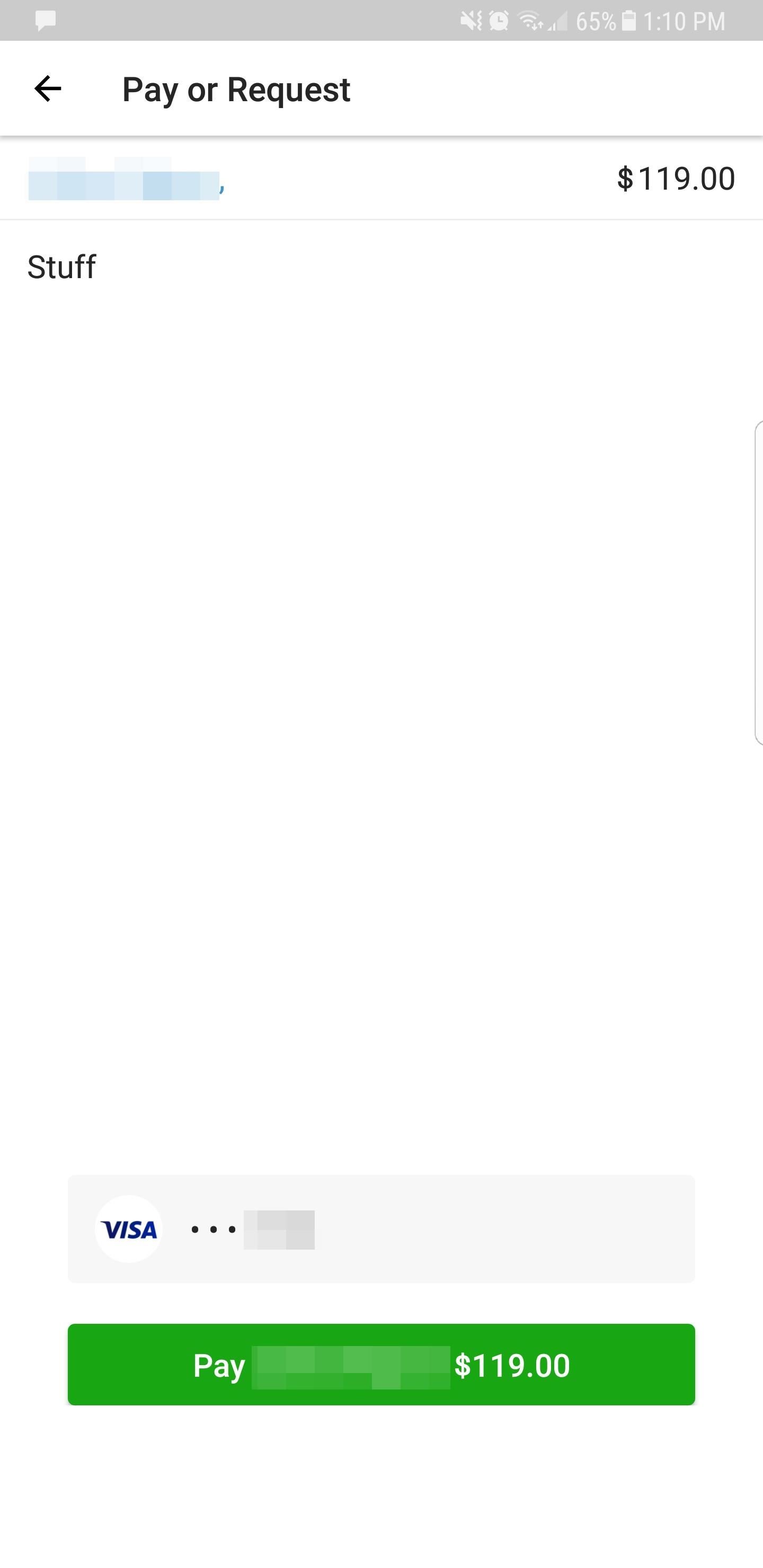

Sounds great until you start subtracting student loan payments income-based repayment plans typically cap them at 8 to 10 and retirement savings ideally 10 to 15. Visit Circle Pay to learn more. 0 if purchasing from authorized merchants 3 if paid by credit card 025 to transfer Venmo balance out of Venmo.

The 10 Best Places to Get an Online Personal Loan. VenmoBest for sending small amounts of money. Venmo is a better option for sending money to friends and family quickly.

It may take up to 10-14 days to get the money from your Credit Reserve Account distributed to you. Is Cash App better than Venmo. Instant transfer to Venmo balance.

Venmo is a popular tool owned by and similar to PayPal. Unrivaled access premier storytelling and the best of business since 1930. Does Renting Build Credit.

Before you default on a student loan you have options such as deferment and. This is in part because the government provides so many options for paying back student loans that it sees default as an extremely serious issue. Buy Now Pay Later BNPL.

Among the top Google searches for 2022 Bitcoin beat out TikTok Apple and NFL and almost. You can send money to friends or request from them and funds are drawn from a linked bank account or debit card at no cost. See how many revolving credit accounts and loans you have in your free credit report summary.

1 to 3 busines days for direct deposit free or instant transfer to your bank account for 1 fee 10 max Standout features. Modern Money offers a wealth of information on topics like banking 101 saving budgeting career and education family finance lifestyle and retirement. How Does Venmo Work.

To simply send and receive money in a C2C way Venmo is the best choice. These fees can range from 15 to 3 and can make the transfer of large amounts costly. On the other hand PayPal is better for more secure safer transactions.

Cost to send money. Fintech lenders had the highest rate of suspicious PPP loans. 229 plus 009 for credit and debit card transactions.

Revolving credit installment loans and the mix of the twostudent loans auto loans mortgages etcmake up 10 of your credit score. P2P payments such as Apple Pay Cash and loan payments or account funding made with your debit card are not eligible for cash back rewards. Gambling transactions peer-to-peer transfers from services such as PayPal Cash App or Venmo.

Circle Pay doesnt charge fees but your bank may. This guide covers all the details you. Researchers estimate that 76 billion in PPP loan money was taken illicitly.

Cost to send money. Explore the list and hear their stories. Check your account mix.

Your guide to the future of financial advice and connection. You can then send yourself money to your other Venmo account from the first bank account. 19 plus 10 cents of the payment.

Transfers into a Venmo are free unless youre using the cash a check feature and transfers out are free unless youre using a credit card a 3 charge. Financial lenders or fintechs made around 29 of all PPP loans but accounted for more than half of its suspicious loans to borrowers. Remember your first step to sending yourself money through Venmo is to link the bank account that you want to deduct funds from to one of your Venmo accounts.

Thats almost 10 of the programs nearly 800 billion budget. Money orders are a declining business for the USPS as companies like PayPal Venmo and others are offering electronic replacements. Both the sender and receiver must live in the United States.

Add your Gold Card to your Uber account and each month automatically get 10 in Uber Cash for Uber Eats orders or Uber rides in the US totaling up to 120 per year. Venmo is an American mobile payment service founded in 2009 and owned by PayPal since 2012Venmo was aimed at friends and family who wish to split bills eg. All of this could subtract another 15 to 20 even without accounting for food entertainment transportation child care additional debt or other savings.

Cash App does pretty much the same thing as Venmo but without the social features. For movies dinner rent or event tickets etc. By Allen Lee May 13 2022 May 12 2022.

Venmo and Cashapp charge fees if users send money using a credit card and if users want to immediately deposit funds into their bank account. Breaking News First Alert Weather Community Journalism.

Using Venmo As A Vehicle For Hidden Assets And Fraud In Divorce Dallas Divorce Law Blog

Borrow The Lending App On Behance

How To Borrow Money From Venmo Ultimate Venmo Loan Guide Aim Tutorials

Venmo 101 How To Send Money To Friends Family Smartphones Gadget Hacks

Venmo Ppp Loan Application Payday Loans App

Venmo Just Updated Some Of Its Privacy Features Popular Science

![]()

Anything Loans Cash Advance By Anything Loans Ltd More Detailed Information Than App Store Google Play By Appgrooves 6 App In Payday Loans Finance 5 Similar Apps 759 Reviews

Venmo Loans Everything You Need To Know In 2022

![]()

Best 10 Apps For Payday Loans Last Updated October 21 2022

Ledge Uses Venmo To Make Borrowing Money And Paying It Back Dead Simple

Venmo Loans Everything You Need To Know In 2022

Venmo Makes Lending Money And Paying It Back Hassle Free By Satinder S Panesar Medium

Can You Borrow Money From Venmo Yes See How

Can You Borrow Money From Venmo How To Get A Venmo Loan

![]()

Venmo Ppp Loan Application Payday Loans App

How To Get Free Money On Venmo Ultimate Guide For 2022 Yotta

Venmo Loans Everything You Need To Know In 2022